excise tax ma pay

Also under MGL Chapter 59 Section 2 it is. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

Motor Vehicle Excise Tax Bills Gardner Ma

Drivers License Number Do not enter vehicle plate numbers spaces.

. Find your bill using your license number and date of birth. The minimum excise tax bill is 5. Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year.

Pay the following Municipal Bills by Electronic Check no fee or Debit Card Credit Card American Express Discover Mastercard or Visa with a fee. If your vehicle isnt. Including real estate property taxes automobile excise taxes trash fees and personal property taxes for other than the.

Payment is due 30 days from the date the excise bill is mailed. Why do we pay excise tax in Massachusetts. Payment by check or money order may be mailed to the Office of the City Treasurer.

Excise tax payments are due 30 days from the original date of the bill after which a demand bill will be sent out with interest and penalty. Payment at this point must be made through our Deputy Collector Kelley. Payment by credit card or electronic check may be made over the phone by calling 877-675-1669.

Credit Debit Cards. 295 100 minimum Excise Tax. Payable in full within 14 days from the date of.

Under MGL Chapter 60A all Massachusetts residents who own and register a motor vehicle must annually pay a motor vehicle excise. Pay DELINQUENT Springfield Taxes and Fees. The excise tax rate is 25 per 1000 of assessed value.

A flat 1000 charge to the bill plus interest at the rate of 12 per annum from the due date to the date of payment. You pay an excise instead of a personal property tax. Excise tax demand bills are due 14 days.

Available payment options vary among services and our online payment. If you are unable to find your bill try searching by bill type. Any unpaid bill accrues interest at a rate of 12 per annum from the 31st day to the date of payment.

The following steps for. Credit or Debit card payments will clear within 30 minutes. According to MGL Chapter.

Like a property tax which. Electronic Check payments will clear in 2 weeks. To pay your bill on-line click here.

The excise tax law establishes its own formula for valuation. An excise must be paid within 30 days of the issuance of the bill. Online payments may be made using checking account information Electronic Funds Transfer or credit cards.

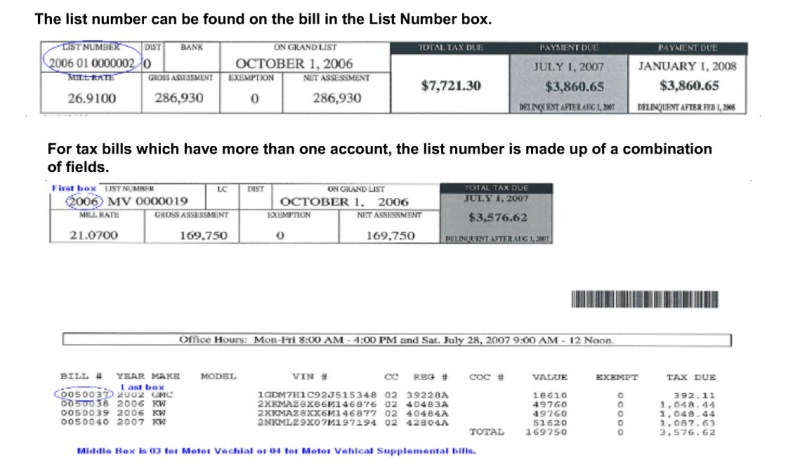

City Of Hartford Tax Bills Search Pay

Do You Report Paid Excise Tax In Massachusetts

Online Payments Watertown Ma Official Website

Massachusetts Lawmakers Mull Doubling Alcohol Excise Tax Across All Categories Brewbound

City Of Lowell Ma Government Motor Vehicle Excise Tax Bills For The 2021 Tax Year Have Been Mailed And Are Due On 3 25 2021 Please Call The Collector S Office If You

Treasurer Collector Town Of Danvers

Ma Motor Vehicle Excise Tax Model 3 Tesla Motors Club

Beer Excise Sales And Meals Tax 101 Massachusetts Brewers Guild

Excise Tax In The United States Wikiwand

Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol For First Time

James Bulger Excise Tax Bills From City Of Boston

Excise Tax Payment Due Monday March 19 The Somerville Medford News Weekly

Town Of Franklin Ma Did You Know That You Can Pay All Of The Following Online Excise Tax Property Tax Utility Bills Real Estate Tax Our Payment

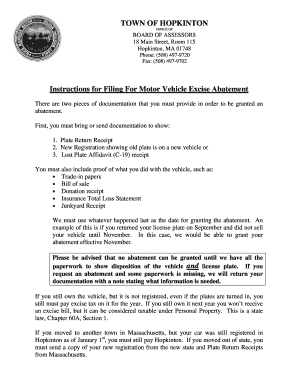

Hopkinton Town Ma Tax Collector Fill Online Printable Fillable Blank Pdffiller

Who Pays Low And Middle Earners In Massachusetts Pay Larger Share Of Their Incomes In Taxes Massbudget

Tax Bill Information Falmouth Ma