tax liens in georgia for sale

Foreclosures and Delinquent Taxes. 90 North Street Canton GA 30114.

Georgia Tax Sales Redeemable Tax Deeds Youtube

View and Pay Property.

. It is also the first step in taking the property to tax sale. Tax Sale Listing Office Marker map. Augusta - Richmond County.

The county does not guarantee title and the purchaser has no use of the property nor. Taxes constitute a general lien. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more.

There are currently 6423 tax lien-related investment opportunities in Georgia including tax lien foreclosure properties that are either available for sale or worth pursuing. The tax commissioner will execute a tax deed after the sale and have the deed properly recorded. Search all the latest Georgia tax liens available.

They are held at 1000 am. 305 South Main St Pearson GA 31642. Tax liens offer many opportunities for you to earn above.

You can then buy the tax lien property at. Tax liens pertain to all kinds of taxes including sales and use income estate motor fuel and road and property taxes. There are currently 537 red-hot tax lien listings in Atlanta Georgia.

The deed along with other pertinent information will be sent to the purchaser at the address. Taxes due the state and county are not only against the owner BUT also against the property regardless of judgments mortgages sales or encumbrances. There are more than 8446 tax liens currently on the market.

You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the property owner. Federal tax liens are attached by the Internal Revenue Service IRS. Buying tax liens at auctions direct or at other sales can turn out to be awesome.

Buying tax liens at auctions direct or at other sales can. Tax Lien Certificates and Tax Deed Sales in Georgia GA Georgia Counties Appling County Athens-Clarke County Atkinson County Augusta-Richmond County Bacon County Baker County. At the Cherokee County Courthouse at.

When a property owner in Georgia fails to pay the property tax the county tax commissioner may sell the real estate to raise money. 9-13-170 ANY PERSON WHO BECOMES THE PURCHASER OF ANY REAL OR PERSONAL PROPERTY AT ANY SALE MADE AT PUBLIC OUTCRY WHO FAILS OR. A tax lien in Georgia is a legal claim on a persons real or personal property for unpaid taxes.

This type of lien can be placed by the federal or state government through an authorized agency. There are more than 8447 tax liens currently on the market. For real property the Tax Commissioner must issue a 30-day notice to the property owner before filing the lien.

Georgia Tax Lien Homes Search all the latest Georgia tax liens available.

2019 Tax Sale City Of Opelousas

2478 Lois Ln Jonesboro Ga 30236 Mls 20061491 Coldwell Banker

Tax Lien Properties Georgia Real Estate Tax Lien Investing For Beginners How To Find Finance Tax Lien Tax Deed Sales Blank Greene E 9781698484204 Amazon Com Books

Form T 4 Fillable Lien Or Security Interest Has Been Satisfied

Free Georgia Motor Vehicle Dmv Bill Of Sale Form Pdf

Chapter 10 Real Estate Taxes And Liens One Type Of Lien Is The Mechanic S Lien Commonly Found In Home Construction Rehabilitation And Addition Projects Ppt Download

Can I Sell My House With A Tax Lien 5 Options For You

Where Are The Tax Sales Tax Lien Investing Tips

How To Buy A Tax Lien In Georgia

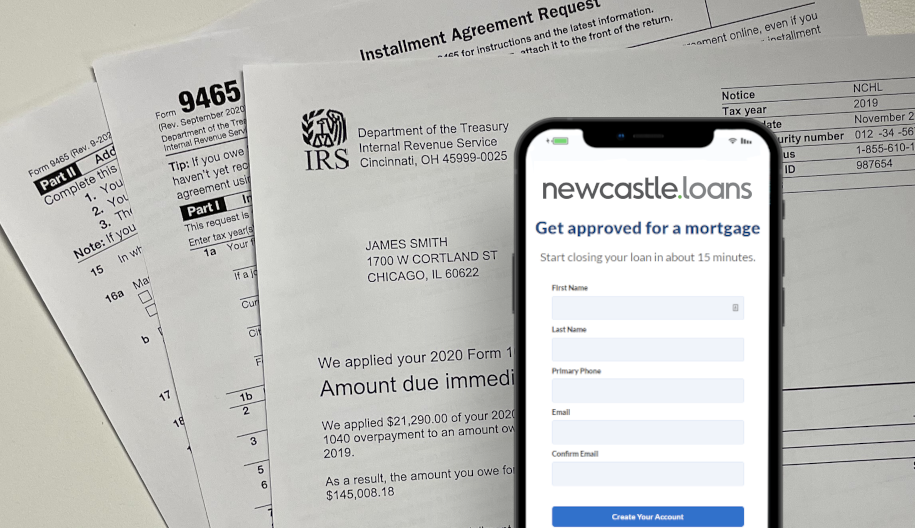

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

Why Activists Are Pushing Nyc To End Its Tax Lien Sale

Property Taxes By State Which Has The Highest And Lowest

How To Buy Tax Lien Certificates In Georgia For Big Profits

North Georgia Mountain Property For Sale North Georgia Mountain Realty Llc Real Estate For Sale In Blue Ridge Ga

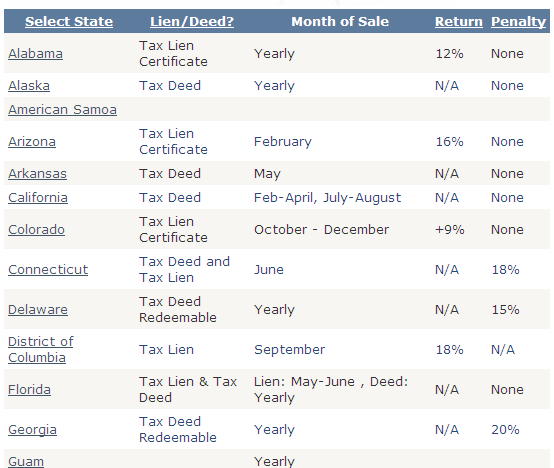

State Directory Tax Sale Resources

A Crash Course In Tax Lien Deed Investing And My Love Hate Relationship With Both Retipster